Türkiye’de bahis severler için en çok tercih edilen bettilt giriş adreslerden biri olmaya devam ediyor.

Curacao lisanslı platformlar arasında güvenilirlik açısından üst sıralarda bahsegel giriş yer alan, uluslararası denetimlerden başarıyla geçmiştir.

Kazançlı bahis deneyimi arayan herkes için bettilt doğru seçimdir.

Rulet masalarında en çok tercih edilen bahis türleri arasında kırmızı/siyah ve tek/çift seçenekleri yer alır; pinco giriş bu türleri destekler.

Basketbol tutkunları için en iyi kupon fırsatları bettilt sayfasında yer alıyor.

Improving Physician Practice Financial Management with Digital Tools

The Financial Health Check-Up

Streamlining Billing Processes

- Automate Claims Submission: Automatically submit claims to insurance companies, reducing the time and effort required by staff.

- Track Claims in Real-Time: Monitor the status of claims and quickly address any issues that arise.

- Reduce Errors: Minimize human errors that can lead to claim denials or delays.

- Improve Patient Communication: Send automated reminders for unpaid bills, reducing the need for manual follow-ups.

Enhancing Revenue Cycle Management

- Identify Revenue Leakage: Detect and address areas where revenue might be slipping through the cracks.

- Optimize Coding: Ensure that all services are coded correctly to maximize reimbursement.

- Predict Financial Trends: Use data analytics to forecast revenue and identify potential financial challenges.

Reducing Overhead Costs

- Automate Administrative Tasks: Reduce the need for manual data entry and other time-consuming tasks.

- Optimize Staff Scheduling: Use digital scheduling tools to ensure that staff is utilized efficiently and avoid overstaffing.

- Manage Inventory: Track medical supplies and reduce waste by ensuring that you only order what you need.

Improving Financial Reporting

- Generate Real-Time Reports: Provide up-to-date financial information at your fingertips.

- Customize Reports: Tailor reports to focus on specific financial metrics that are important to your practice.

- Analyze Data: Use data analytics to identify trends and make informed financial decisions.

Enhancing Patient Payment Processes

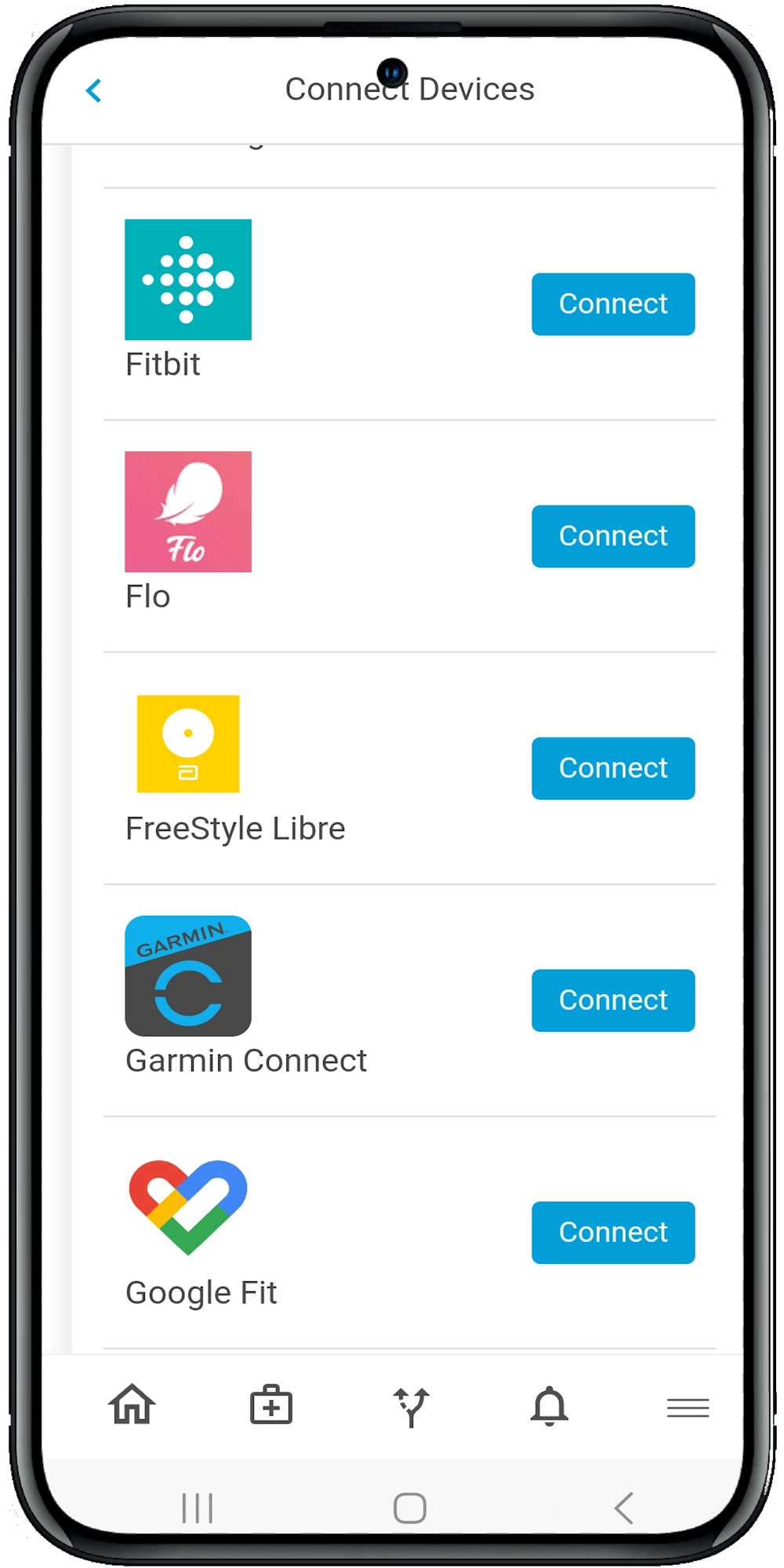

- Offer Multiple Payment Options: Allow patients to pay via credit card, online portals, or mobile apps.

- Set Up Payment Plans: Enable patients to set up payment plans for large bills, increasing the likelihood of full payment.

- Provide Transparent Billing: Offer clear and understandable billing statements, reducing confusion and increasing patient satisfaction.

Leveraging Telehealth for Financial Benefits

- Expand Patient Base: Reach patients who may not be able to visit your practice in person.

- Reduce No-Shows: Telehealth appointments are less likely to be missed, ensuring a more consistent revenue stream.

- Lower Operational Costs: Reduce the need for physical space and resources for in-person visits.

Utilizing Data Analytics

- Monitor Key Performance Indicators (KPIs): Track important financial metrics such as patient volume, average revenue per patient, and collection rates.

- Identify Trends: Analyze data to identify trends and make proactive financial decisions.

- Benchmark Performance: Compare your practice’s financial performance against industry standards.

Ensuring Compliance and Security

- Automate Compliance Checks: Ensure that your billing processes comply with the latest regulations.

- Secure Data Storage: Use encrypted digital storage solutions to protect patient financial information.

- Monitor for Fraud: Implement tools that detect and prevent fraudulent activities.

Summary and Suggestions

Improving the financial management of your physician practice is not just about cutting costs or increasing revenue—it’s about creating a sustainable and efficient system that allows you to focus on what you do best: providing excellent patient care. By leveraging digital tools, you can streamline billing, enhance revenue cycle management, reduce overhead costs, and much more.

Ready to take the next step? Explore our other resources on digital health strategies or schedule a demo to see how our digital health platform can transform your practice’s financial management.